This interest-earning checking account offers customers with more perks than the bank's other bank accounts combined. You'll still have access to overdraft protection, buffers and fee erasers. But being a Premier client enables you to earn triple rewards points on a World Mastercard® credit card and use your Premier Mastercard® debit card at any ATM in the world for free. Your debit card will also carry higher transaction dollar limits, chip technology and fraud protection.

We offer a convenient location and a variety of U.S. Bank products and services, including savings and checking accounts, retirement planning services, business loans, mortgages, personal lines of credit, credit cards and more. Make us your financial partner and let us help you reach your banking goals.

Bank of the West has customers in all 50 states and operates more than 700 branch banking and commercial office locations in 19 Western and Midwestern states. Prudent credit underwriting, a diversified loan portfolio, and careful risk management have allowed them to grow to more than $62 billion in assets. They are one of the nation's largest banks, yet preserves their local feel and their award-winning style of relationship banking that ensures superior customer service. Bank of the West offers a variety of financial services; including checking and savings accounts, credit cards, auto, home and personal loans.

Visit us online or at any of our more than 500 branch locations. When you have this money market account, you'll never face fees for deposits and withdrawals you make at a branch or ATM. Don't forget that as a savings account, money market accounts still limit your outgoing transactions to six per statement cycle. You can access your money wherever you can find the bank.

This means at a branch, ATM, online, over the phone or on its mobile app. Whenever you want to access your money at an ATM, you'll need your Bank of the West debit card and PIN. Be ready to have your personal and account information ready when you want to access your money through any other method. Bank checking, savings or money market account can buy and/or sell foreign currency at this branch. Place an order for Euros or other foreign currency and pick them up the next day.

Wait times to talk to someone are so long one finally gives up. I spent literally hours yesterday trying to talk to someone. After hours of waiting, the woman said she would have to transfer me.

I have never dealt with a worse financial institution in my life. I have accounts with a bank and two credit unions all have great customer service. As I write this review I have been on hold for 45 minutes. I will pay off this loan early & never deal with this bank again. Folks in the great state of Arizona trust WaFd Bank for all their personal and commercial banking needs. Whether you're looking for a mortgage in Phoenix or to open a business checking account in Tucson, or free checking in Yuma, we are here to serve you.

For more than 100 years WaFd bank has served the communities of the West. Sunwest Bank Mobile is compatible with iOS devices and Android-powered devices. While the Sunwest Bank Mobile app is free to download, message and data rates may apply. Check with your mobile services provider for any charges that may apply for data usage on your mobile device. Please refer to the Mobile Banking and Online Services Agreement for further details regarding Sunwest Bank mobile banking services.

To obtain a money order or cashier's check from U.S. I have been a customer personally and through my business for approximately 22 years. I have endured many mistakes such as the most recent $150,000 bank error. Managers failing to properly close accounts and hours on hold trying to find out what is happening with my account.

Yet I decided to apply for a HELOC loan with BOW because I had been with them 22 years. I have excellent credit, a high excellent fico score, minimal debt , cash and assets. Choose the checking account that works best for you. See our Chase Total Checking®offer for new customers. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and 16,000 ATMs and more than 4,700 branches. Key Features Details Minimum Deposit $100 Access to Your Checking Account Online, mobile, over the phone and at physical branches.

Security FDIC insurance up to the maximum amount allowed by law. These additional deposits must be at least $100, but you can make them at any time. They will earn interest at the rate the account earned when you opened it.

It's important to remember that this account is still an IRA. That makes it subject to IRA contribution limits that you have to be aware of. Exceeding these limits can get you into some trouble with the IRS.

You have a number of opportunities to earn higher and higher interest rates with a Bank of the West Choice Money Market account. For starters, you should link your money market account to a Bank of the West checking account. The exact rates will depend on the checking account you open and link. Further, there's a balance sweet spot for each set of rate tiers. For example, if you link a Premier Checking account and your money market account has a balance of $50,000, you'll earn at the highest rate possible with a Choice Money Market account.

West Valley National Bank was formed by a group of local residents from the West Valley area of Phoenix, Arizona. They strategically discussed the lack of quality financial services available to the small businesses in the West Valley. Bank of the West fosters an environment where team members are engaged, supportive of one another and enthusiastic about serving customers. The company is part of BNP Paribas, a European leader in global banking and financial services.

The Bank offers opportunities across diverse business lines with major offices in San Francisco and Tempe. Our Sun City West location, a storefront BBVA branch, is located across from Fry's Food and Drug and next to Goodwill for easy-access banking. We're here Monday through Friday, ready to help you discover the right financial solutions to fit your lifestyle. Founded in 1874, Bank of the West provides personal, commercial, wealth management and international banking services through more than 600 branches and offices in 23 states. European parent BNP Paribas, which is headquartered in Paris, counts more than 192,000 global employees.

Banking, credit card, automobile loans, mortgage and home equity products are provided by Bank of America, N.A. And affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation. Programs, rates, terms and conditions are subject to change without notice.

Zelle in our mobile app is a fast, safe way to send and receive money with friends, family, and businesses you trust no matter where they bank in the U.S. -- with no fees in our app. Follow the prompts to enroll, which include adding your U.S. mobile number or email that others can use to send you money. Say you want to send $20 to Tim for yesterday's lunch.

Enter Tim's contact information or select Tim from your contact list. Enter the amount, select the account, and tap Continue. Verify Tim's information is correct, then tap Send. If he's already enrolled with Zelle, Tim will get a text or email saying you sent him money, and the funds will go directly to his bank account. If he's new to Zelle, the text or email will include a link with instructions on how to receive his money.

You can also request money, like rent from your roommates, or to split expenses for that weekend trip. Keep in mind, with Zelle your money moves from your bank account to someone else's in minutes. So it's important you know and trust who you are sending money to and never use it with others who you don't know, or to pay for goods and services you have not yet received. So next time you need to send or receive money, just open your Bank of America app and tap Transfer | Zelle. Bank of the West makes its simple checking account accessible to more customers with its "any deposit" amount allowances. You can open the account with any amount as your deposit.

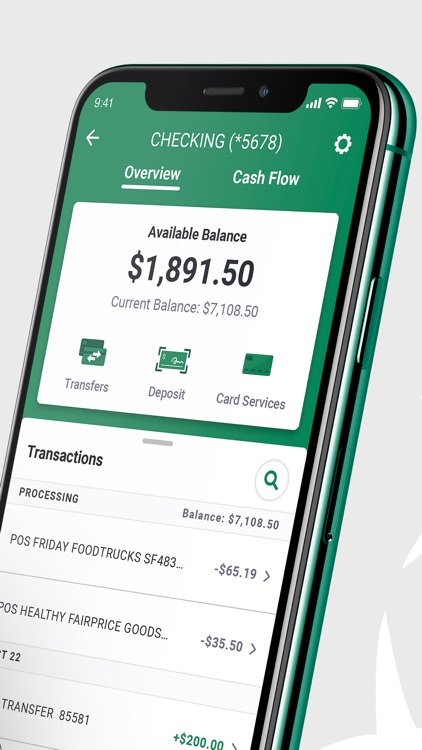

Plus, you can easily avoid the monthly fee by making a deposit of any amount each statement cycle. There is no minimum you need to meet to save your money. Bank of the West offers its customers the ease of online and mobile banking. When you access your account online, you can track your spending and budgets, pay bills, transfer money, set up email and text alerts and more. This site is designed to help people locate their bank's nearest branch locations, lobby hours, and online banking information. This site is not run by, endorsed, or associated with Bank Of The West in any way.

Data is updated periodically from the FDIC's databases. Make your best financial decisions with guidance from our experienced staff. At our Sun City West branch, customer service representatives are available for English-speaking individuals to more fully answer your personal banking questions. Are you looking for a financial center in Sun City West to assist you with personal or small business banking?

Whether you're online, at the branch, or over the phone -- we're here when you need answers. Bank of the West, more than 135 years old, has more than 700 locations. It offers solutions in personal, small business and commercial banking, as well as wealth management and asset protection. Chase Bank serves nearly half of U.S. households with a broad range of products. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback.

With Business Banking, you'll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and on managing payroll. Chase also offers online and mobile services, business credit cards, and payment acceptance solutions built specifically for businesses. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Online and mobile banking both allow you to check on your balances, make transfers, deposit checks and more. The mobile app is also equipped with security measures like Touch ID.

As a checking account, you'll receive a free Mastercard® debit card. You can use this card for free at any Bank of the West location or ATM. If you use any non-Bank of the West ATM, the bank will charge you $2.50 for each withdrawal. Most of the following bank accounts have minimum deposit requirements and charge monthly fees.

It's important to check those out so you don't get blindsided when you open an account. Locations with Bank of the West offices are shown on the map below. You can also scroll down the page for a full list of all Bank of the West Arizona branch locations with addresses, hours, and phone numbers information.

ATM Access Codes are available for use at all Wells Fargo ATMs for Wells Fargo Debit and ATM Cards, andWells Fargo EasyPay® Cards using theWells Fargo Mobile® app. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Some ATMs within secure locations may require a card for entry. Digital wallet access is available at Wells Fargo ATMs displaying the contactless symbol for Wells Fargo Debit andWells Fargo EasyPay® Cards in Wells Fargo-supported digital wallets. From business checking accounts to commercial loans, our business bankers can assist you with financial solutions to fit your specific business needs.

We are retired and seniors, we do not have the income stream we used to have. What we do have is assets, great credit, perfect credit history. They did not verify our retirement accounts, other bank accounts or even give us the opportunity to allow these to be a part of the loan application. Imagine if you are retired and traveling and you suddenly cannot use your funds from your account. "Ooops sorry we accidentally put 150k of someone else's money in your account and now we are taking it out with a $35 NSF fee." Who discovered the error, me. How often have you attempted to reach BOW via telephone or online only to be told they were closed or systems were down.

Everyday Banking With the Bank of America Mobile App, managing your money has never been easier or more secure. You can conveniently deposit checks anytime from almost anywhere. And stay in the know with Security and Account alerts. Use My Rewards to view all of your rewards in one place. Replace a lost or stolen card OR lock and unlock your debit card, all with a few clicks. And you'll have easy access to your statements… All to help you stay on top of your finances with the Bank of America Mobile App.

The catch for those who are eligible to open an account is that Bank of the West doesn't offer the best rates in the industry. Most accounts have interest rates well below the national average. These accounts also have high minimum deposit requirements and monthly fees. Also, while anyone can access the bank's website, like SmartAsset in New York, only customers who live in the 19 states the bank services will be able to open an account online . While the account earns at the lowest interest rate in the industry, you won't face fees for deposits and withdrawals when you make them at a branch or ATM.